Introduction: Why HS Codes Determine Your Profit

For any B2B importer, sourcing the product is only half the battle. The other half is getting it through customs without unexpected penalties.

We often hear from new wholesale clients: “Why did customs charge me 30% tax when my competitor only pays 10%?” The answer usually lies in the HS Code (Harmonized System Code) classification.

In this comprehensive guide, Camp Auto Parts breaks down the exact classification for 2026, the specific duty rates for major markets (USA, EU, Australia), and provides a real-world calculation example to help you forecast your profits.

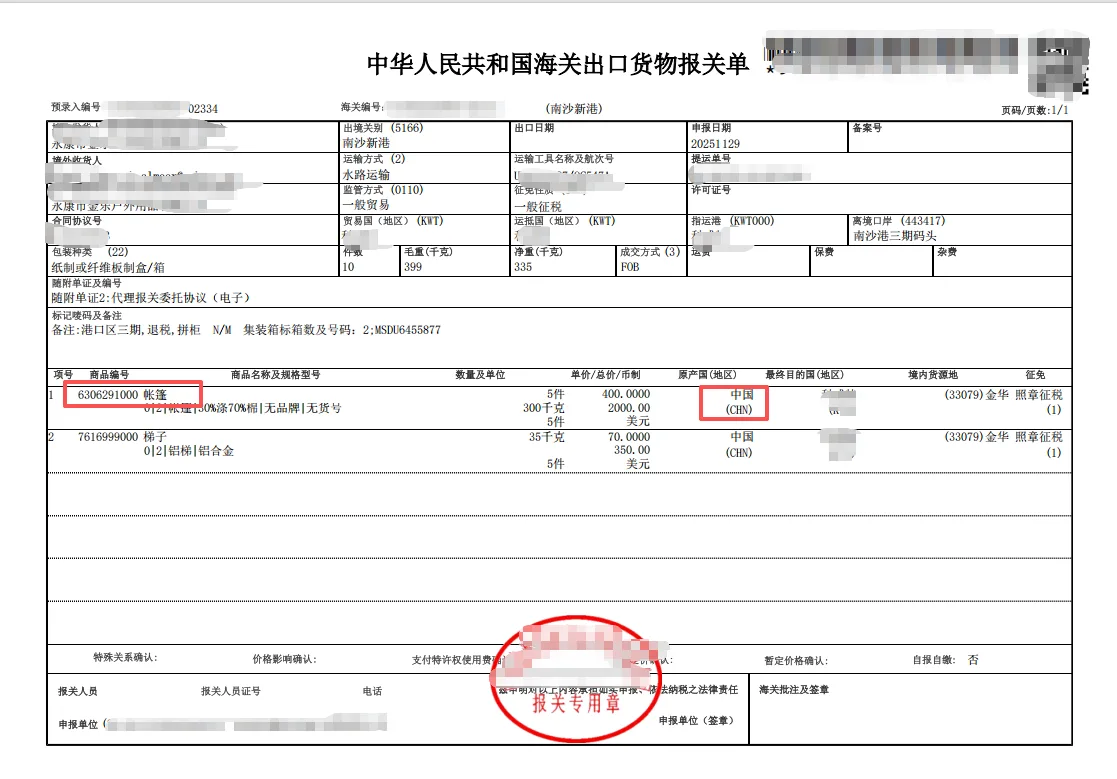

What is the Correct HS Code for Roof Top Tents?

There is often confusion about whether a roof top tent is an “Auto Part” or a “Textile Product”. Here is the official ruling used by global customs authorities.

The Definitive Code:

China Export HS Code:

6306.29.1000International Root Code (First 6 Digits):

6306.29

Code Breakdown (Logic):

Chapter 63: Other made-up textile articles; sets; worn clothing.

Heading 06: Tarpaulins, awnings and sunblinds; tents; sails for boats.

Subheading 29: Of other textile materials (Synthetic fibers like Poly-Cotton or Oxford).

⚠️ Critical Warning: Do NOT attempt to classify roof top tents under Chapter 87 (Auto Parts) to avoid high textile tariffs. Customs authorities inspect these goods physically. If they see fabric, they will re-classify it to 6306 and may issue a fine for misdeclaration.

Camp Auto Parts Team

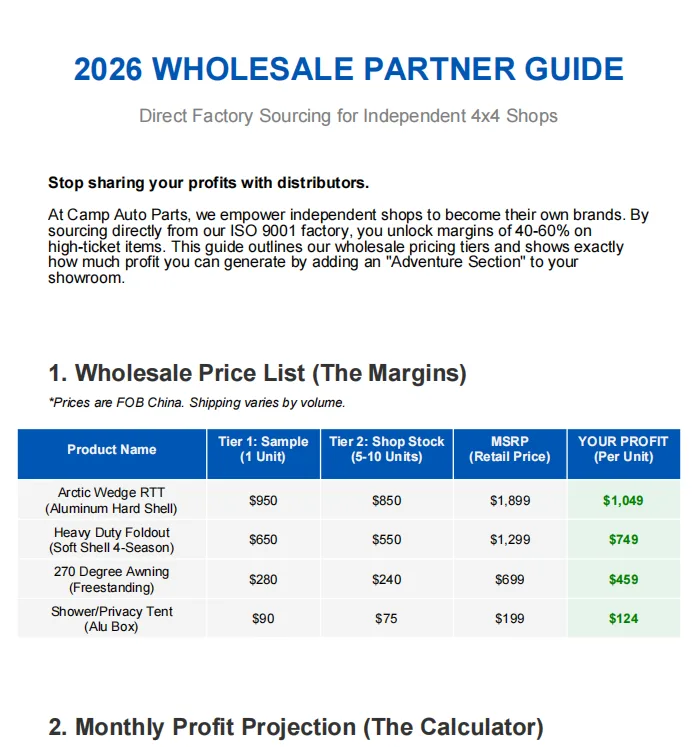

2026 Import Duty Rates by Region (Cheat Sheet)

Different countries treat Chinese-manufactured tents differently. Here is the forecast for 2026 based on current trade agreements.

| Target Market | HS Code Used | Standard Duty (MFN) | Trade War / Additional Tariff | Total Estimated Duty |

|---|---|---|---|---|

🇺🇸 USA | 6306.29.00 | 8.8% | +25% (Section 301 List 4A) | ~33.8% |

🇪🇺 Europe | 6306.29.00 | 12% | 0% | 12% |

🇨🇦 Canada | 6306.29.00 | 18% | 0% | 18% |

🇦🇺 Australia | 6306.29.00 | 5% | 0% (Free with COO) | 0% (with FTA) |

🇯🇵 Japan | 6306.29 | 3.2% - 5.3% | 0% (RCEP) | ~4% |

Note: Rates are subject to change. Always verify with a local customs broker.

Case Study: Calculating Your Landed Cost (Math Example)

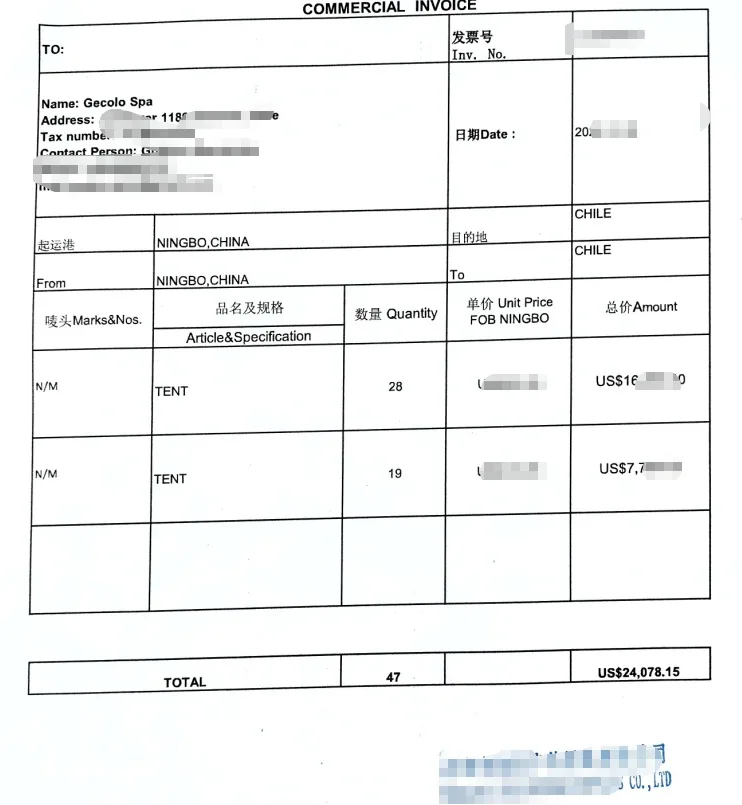

Let’s calculate the real cost of importing 20 units of Aluminum Hard Shell Tents to the USA vs. Europe.

Scenario:

FOB China Price: $800 per unit.

Order Volume: 20 Units.

Total FOB Value: $16,000.

Shipping (Sea Freight): $2,500 (Estimate).

🇺🇸 Option A: Importing to USA (High Tariff)

Base Duty (8.8%): $16,000 * 0.088 = $1,408

Section 301 Tariff (25%): $16,000 * 0.25 = $4,000

Total Duty: $5,408

Total Landed Cost: $16,000 + $2,500 + $5,408 = $23,908

Cost Per Unit: $1,195.40

🇪🇺 Option B: Importing to Europe (Standard Tariff)

Duty (12%): $16,000 * 0.12 = $1,920

Total Landed Cost: $16,000 + $2,500 + $1,920 = $20,420

Cost Per Unit: $1,021.00

Insight: Even with the same factory price, the landed cost in the US is ~$175 higher per unit due to tariffs. US buyers must factor this into their retail pricing.

How Camp Auto Parts Helps You Save Money

We cannot change the law, but we can optimize the process. Here are 3 ways we help our wholesale partners reduce risk and cost.

1. DDP Service (The "All-In" Price)

For US and EU clients, we offer DDP (Delivered Duty Paid) shipping.

We quote you one final price that includes the product, shipping, AND duty.

Why it helps: We consolidate shipments to get bulk freight rates, often making DDP cheaper than if you handled shipping and taxes yourself.

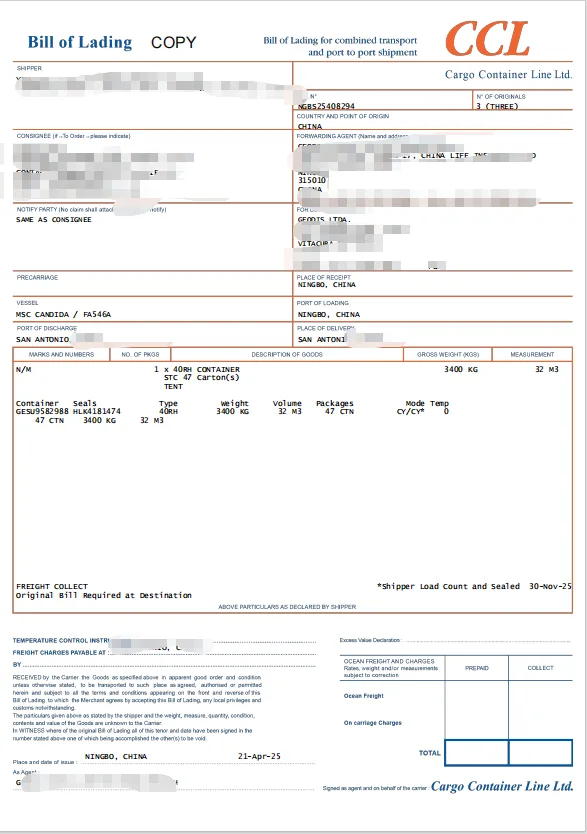

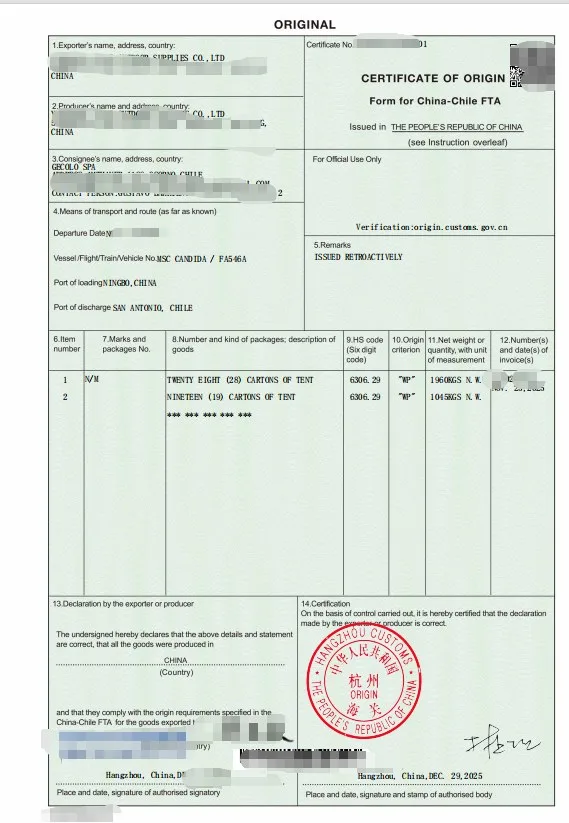

2. Free Trade Agreement (FTA) Documentation

For countries like Australia, New Zealand, Korea, and ASEAN nations, China has Free Trade Agreements.

We provide the official Certificate of Origin (Form A / Form E / Form F).

Result: Your import duty drops from 5-10% to 0%.

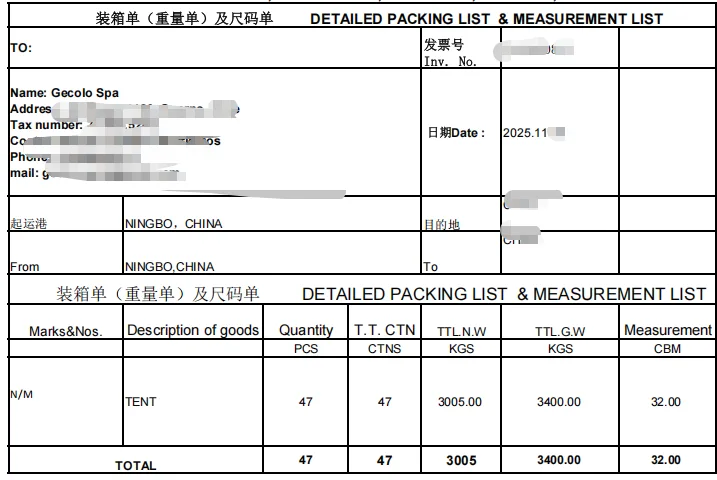

3. Correct Invoice Declaration

We ensure the Commercial Invoice accurately reflects the value and HS codes to prevent customs hold-ups. (Note: We do not support illegal undervaluation, but we ensure no accidental over-valuation).

Frequently Asked Questions (FAQ)

Q: Can I use HS Code 8708 (Auto Parts) to pay lower duty?

A: No. While it is tempting, roof top tents are textile shelters. Using the Auto Parts code is considered “Misclassification” and can lead to retroactive fines and cargo seizure. Stick to 6306.29.

Q: Do these rates apply to accessories like Awnings?

A: Car Awnings generally fall under the same HS Code 6306.29 (Tarpaulins, awnings and sunblinds). The duty rates are usually identical.

Q: Does the “9cm Ultra-Thin” aluminum shell change the code?

A: No. Even though it is mostly aluminum, its primary function is still a “tent”. The textile classification (6306) takes precedence over the material.

Conclusion

Successful importing requires precision. By using the correct HS Code 6306.29.1000 and planning for duties, you can protect your margins.

Ready to start your order?

[ Contact Us for a DDP Quote Today]